ev tax credit 2022 cap

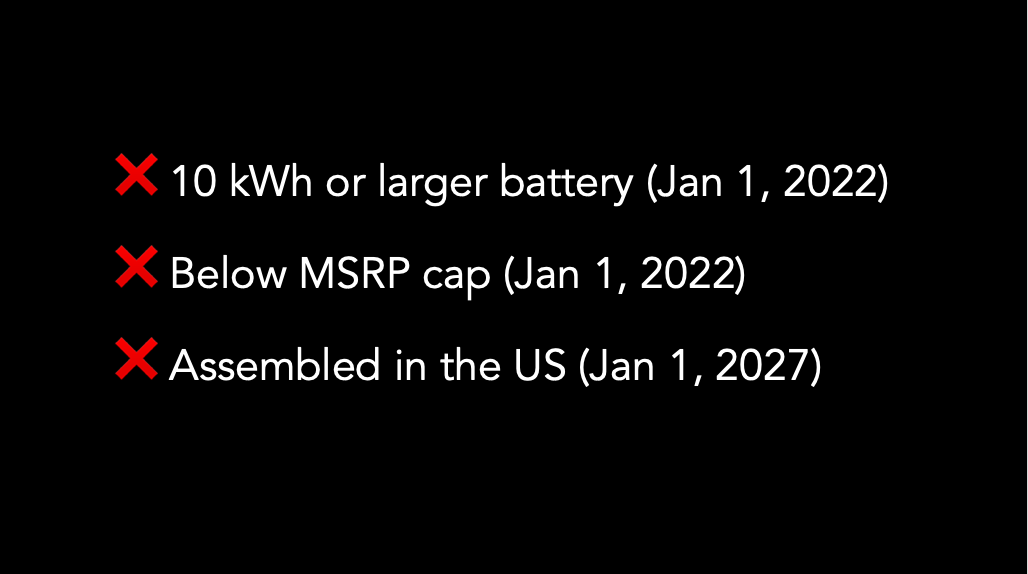

The IRS will not go over and above this total tax liability figure and in this example the remaining 4500 of the EVs total tax credit will not be useable. This rule is clearly intended to incentivize both US and non-US OEMs to assemble their EVs in the US.

Up to 4000 for the purchase of a used all-electric vehicle.

. Thats because this Wrangler is a 4XE model with. Heres how you would qualify for the maximum credit. Worried that if variables like the battery size income cap msrp cap change I could be out of all the 7500.

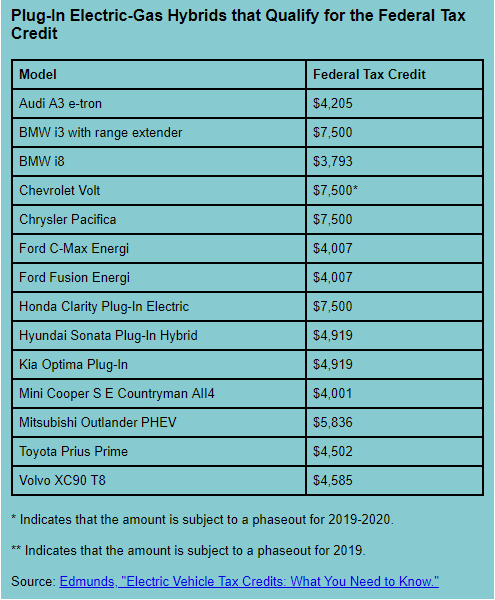

The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles. Increasing the base credit amount to 4000 from 2500 is fine. 36 mpg in hybrid mode.

Up to 5000 rebate on the installation of a charging station at your work or multi-unit residential building. Its eligible for a 7500 tax credit. As mentioned below however the 10 kWh.

Senate passes measure for 40000 cap on the EV tax credit and only EVs priced under 40000 would be eligible for 7500 credit under this plan. QUALIFIED EDUCATION EXPENSE TAX CREDIT January 31 2022 The Qualified Education Expense Credit Cap is 100 million 2022 Year. President Bidens EV tax credit builds on top of the existing federal EV incentive.

For preapprovals processed through the date of this report 81863478 of the 100 million cap has been preapproved. Up to 600 for the purchase of a home charging station. Current EV tax credits top out at 7500.

The current tax credit has a base of 2500 and is replaced with a new 4000 base credit as long as the EV has a battery of at least 10 kWh and can be plugged in and recharged. What happens if new ev tax credit or rebate laws are passed in 2022. 10 hours agoThe federal EV tax credit is 7500 while some states like New Jersey offer as much as 5000 in additional incentives The single-motor Polestar 2 starts at 45900.

4000 Base Tax Credit. Will the cars currently eligible for the 7500 credit still qualify for the tax credits available when purchased or will they have to meet the new legislation terms. What Is the New Federal EV Tax Credit for 2022.

2022 Chevrolet Bolt EV. Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. SUBJECT Electric Vehicle Charging Station Tax Credit SUMMARY This bill under the Personal Income Tax Law PITL and the Corporation Tax Law CTL would allow a credit equal to 40 percent of the costs paid or incurred by the owners or.

As part of a separate bill legislators are considering a 2500 federal tax credit for used EVs as well. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. From 2020 you wont be able to claim tax credits on a Tesla.

84-mpg equivalent on EV power for first 37 miles. 2022 Calendar Year Federal Poverty Level Information. General Motors became the second manufacturer to hit this milestone in the final financial quarter of 2018.

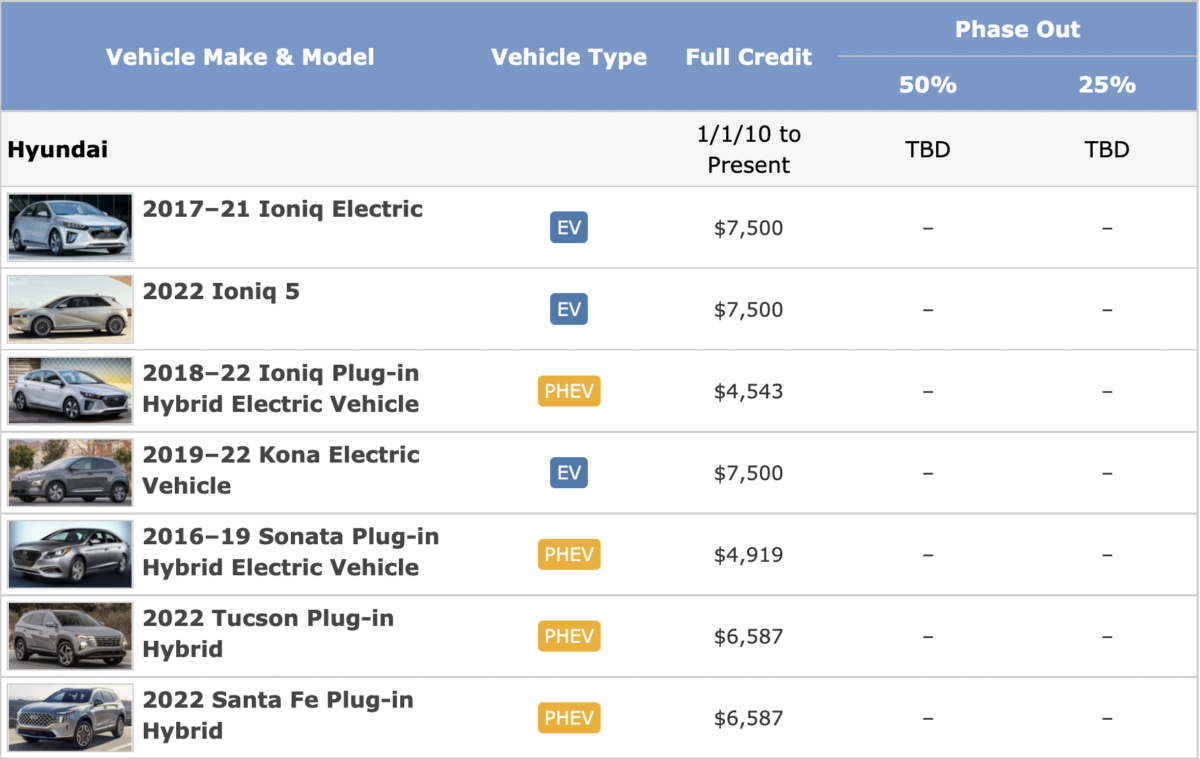

As such there is 18136522 remaining in the cap. The credit ranges between 2500 and 7500 depending on the capacity of the battery. Lexus NX 450h Plus.

The Japanese automaker which has offered hybrids and plug-in hybrids longer than the majority of other brands is about to hit the 200000-vehicle cap for the current federal tax credit limit. Therefore if you owe more than 7500 in federal taxes in 2021 then taking delivery this year may still get you the original EV tax credit. The credit applies to the year you buy the vehicle and your tax credit is capped at how.

Keep in mind that the Canada EV incentives and rebates listed above may change depending on program availability. While foreign-based OEMs will be affected the most US automakers will also lose out on the credit in some cases as the Ford Mustang Mach-E is currently produced in Mexico and. From April 2019 qualifying vehicles are only worth 3750 in tax credits.

2500 additional tax credit for qualifying EVs with final assembly in the US effective January 1 2022. Federal EV tax credits of 2500-7500 are available for new EVs and plug-in hybrids but not for hybrids. What changes on Jan 1 2022 is the increase to 10000 for American made 12500 for union American made vehicles and it will be a refundable tax credit.

1 day agoYou may recognize that 7500 figure is the same as the federal EV tax credit it sure is. Toyota is about to launch the all-electric bZ4X electric SUV in the middle of 2022 but its going to be in a tricky situation. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

Federal Tax Credit Up To 7500. The new credits if Biden and Democrats finalize a deal would jump to 12500 maximum. Then from October 2019 to March 2020 the credit drops to 1875.

To qualify automakers must build the EV in the US with union labor for an extra 4500 over the current. If an EV buyer has a tax bill of say 3000 at the end of the year the EV tax credit can only be a maximum of 3000. 1 hour agoSan Diego Gas Electric said Thursday its residential customers will receive a break on their utility bills of up to 17140 under Californias cap-and-trade program to reduce greenhouse gases.

The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. All-electric and plug-in hybrid cars purchased new in or after. Automotive Editor - January 7 2022.

Used Ev Tax Credit Union Built Bonus Part Of House Social And Climate Bill Now Headed To Senate

Mini Cooper Electric Tax Credit Off 76

Ev Federal Tax Credit Electrek

.jpg)

Latest On Tesla Ev Tax Credit March 2022

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Ev Incentive Hike Faces Tortuous Path Through Congress Forbes Wheels

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

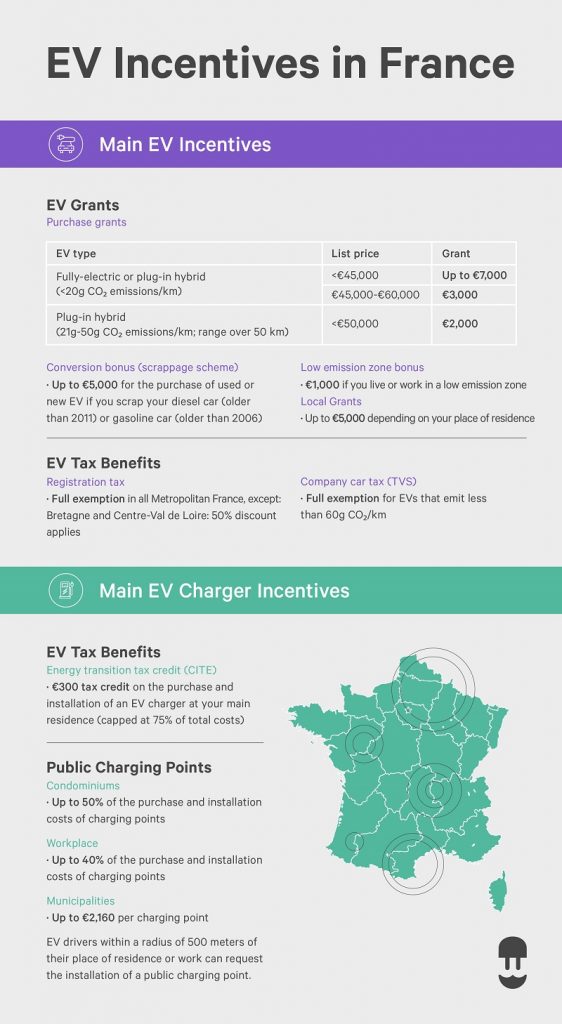

How To Get An Ev Subsidy In France Evolve

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

The Tax Benefits Of Electric Vehicles Saffery Champness

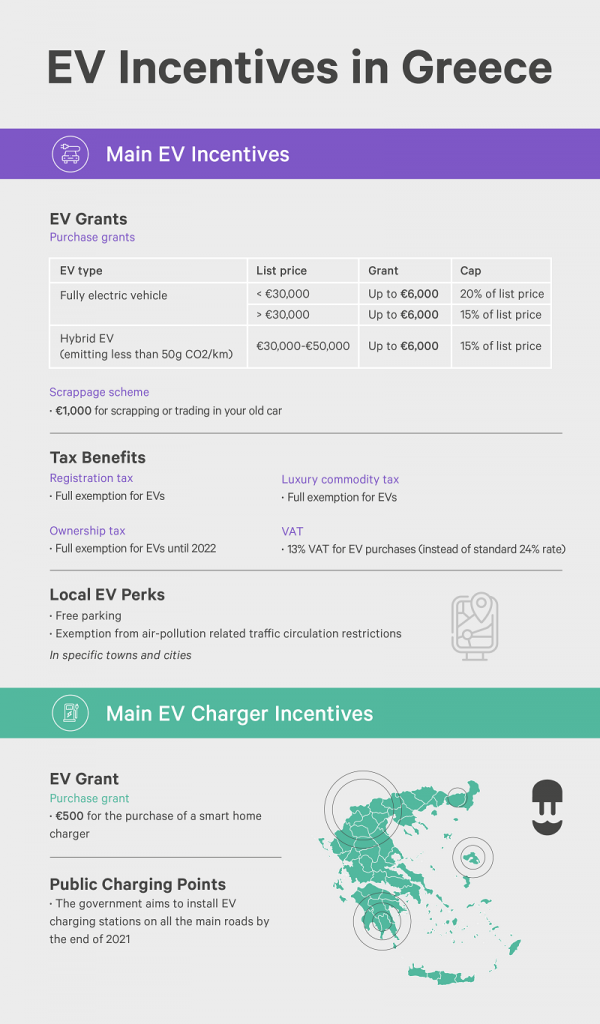

Ev Ev Charging Incentives In Greece A Complete Guide Wallbox

Latest On Tesla Ev Tax Credit March 2022

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Ev And Ev Charger Incentives In Europe A Complete Guide For Businesses And Individuals